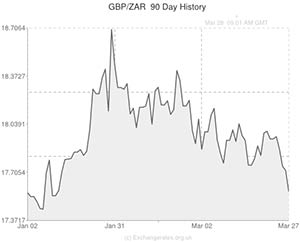

After brushing a three-month high against the US Dollar yesterday, the Rand trimmed gains this morning. The Rand to Pound exchange rate also edged lower.

Yesterday the South African Reserve Bank opted to leave interest rates unaltered following January’s surprise hike.

The Repurchase rate was left at 5.5 per cent as a result of global and domestic conditions, but not all members of the Monetary Policy Committee were in agreement, with four voting in favour of holding rates and three voting for an increase.

Gill Marcus, Governor of the Reserve Bank, asserted; ‘we wish to reiterate that even though we are in a tightening cycle, there will not necessarily be a change in the stance at every meeting, and that the increments may not always be of the same magnitude.’

When speaking of South Africa’s economic outlook, Marcus commented that it ‘remains subdued amid continued strikes in the platinum sector and uncertainty regarding a stable and sufficient electricity supply in the coming months.’

With that in mind, the central bank lowered its growth forecast from 2.8 per cent to 2.6 per cent for 2014. The South African economy is now forecast to expand by 3.1 per cent in 2015 rather than the 3.3 per cent previously expected.

While the Rand initially approached a three-month high against the US Dollar in the aftermath of the decision the USD/ZAR pairing fluctuated following the release of US growth data, initial jobless claims figures and pending home sales report.

As trade progressed on Friday the Rand was holding fairly steady. Comments issued by China’s Premier indicated that the world’s second largest economy will take measures to support its economic growth and emerging market assets like the Rand were boosted as a result.

However, the Rand slipped slightly against the Pound as the British currency continued to derive underlying support from yesterday’s impressive UK retail sales figures.

Further Sterling strength was occasioned by a report showing that UK consumer confidence achieved its highest level since mid 2007.

The GfK index achieved -5 in March, up from -7 in February. According to one GfK representative; ‘The current long-term trend is very strongly positive. People are now on balance more positive than negative about their own financial prospects over the next year, and it is unlikely that anything announced in the recent (government) budget will reverse this’.

Pound gains were slightly limited as the UK recorded a larger-than-anticipated current account deficit.

Next week South African data to be aware of includes the nation’s private sector credit and balance of trade report and consumer confidence figures.

UK reports, including manufacturing/services PMI, could also have an impact on the pairing.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.6375,

,South African Rand,17.6375,

Euro, ,South African Rand,14.5616,

,South African Rand,14.5616,

US Dollar, ,South African Rand,10.6152,

,South African Rand,10.6152,

Australian Dollar, ,South African Rand,9.8305,

,South African Rand,9.8305,

New Zealand Dollar, ,South African Rand,9.1921,

,South African Rand,9.1921,

Canadian Dollar, ,South African Rand,9.5239,

,South African Rand,9.5239,

[/table]

Comments are closed.