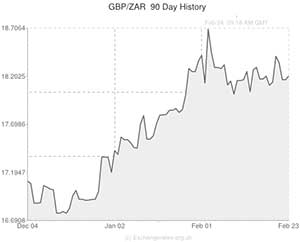

The Rand weakened against the Pound and trimmed gains against the US Dollar this morning as investors focused on this week’s influential South African developments.

For example, tomorrow sees the publication of the nation’s GDP growth rate figures.

South Africa’s PPI reports are due out on Thursday and trade balance figures on Friday.

But the week’s biggest domestic news will be Finance Minister Pravin Gordhan presenting the annual budget.

Some industry experts feel that Gordhan is unlikely to outline any big changes, tax alterations or policy tweaks so close to the election, but will instead offer some preliminary results from the Davis tax review and highlight the recent increases to social grants.

Economists have also forecast that the Minister will slash his growth projections for the year, estimating economic expansion of 2.6 per cent for 2014 rather than the 3 per cent gross domestic product growth envisaged last October.

Government figures estimate that the South African economy expanded by just 1.9 per cent last year, its slowest pace of annual expansion since the recession in 2009.

Tomorrow’s GDP data is expected to show expansion of 3.5 per cent in the fourth quarter of last year.

Unrest in South Africa’s all-important mining/platinum sectors has left question marks over the nation’s economic performance, while the prospect of a slowdown in China and the Federal Reserve continuing with the steady tapering of stimulus have applied additional pressure. The weak Rand has also been a point of concern.

As highlighted by currency strategist Bruce Donald; ‘The fiscal stance is probably most relevant for the Rand via any consequences it has for perceptions of creditworthiness and thus debt ratings.’

The Rand’s relationship with the Pound was particularly bearish as the British asset widely gained in response to supportive comments issued by Bank of England Governor Mark Carney.

Carney’s assertion that the BoE wouldn’t do anything to jeopardise the UK’s economic recovery helped the Pound strengthen to an almost four-year high against the US Dollar and saw Sterling advance on the majority of its other most-traded peers.

As trading continues the Rand could recover some of its losses against the US Dollar as a result of the Chicago Fed Nat activity index slipping by more than forecast in January. The Dallas Fed manufacturing activity index could also have an impact on the USD/ZAR pairing.

Tomorrow’s South African growth data will be the main cause of GBP/ZAR movement, although fluctuations could also be inspired by UK loans for house purchase and CBI reported sales figures.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.1599,

,South African Rand,18.1599,

Euro, ,South African Rand,15.0249,

,South African Rand,15.0249,

US Dollar, ,South African Rand,10.9305,

,South African Rand,10.9305,

Australian Dollar, ,South African Rand,9.8562,

,South African Rand,9.8562,

New Zealand Dollar, ,South African Rand,9.0993,

,South African Rand,9.0993,

Canadian Dollar, ,South African Rand,9.8863,

,South African Rand,9.8863,

[/table]

Comments are closed.