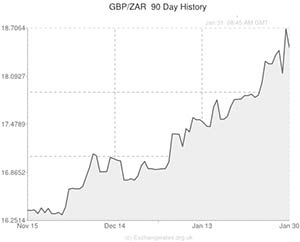

A volatile trading week left the Rand weaker against the majority of its peers as the Fed’s decision to persevere with tapering stimulus dampened the appeal of emerging market assets.

Ongoing domestic labour market concerns and the Reserve Bank of South Africa’s decision to introduce an unexpected rate increase also kept the Rand trading lower against the Pound and US Dollar.

The currency was slightly steadier this morning, although an upbeat UK consumer confidence report did support the Pound against its South African rival before the release of SA trade balance figures.

In the opinion of Absa Capital; ‘Given the extent to which the Rand has weakened this week and considering there is a chance today’s trade balance reading could be encouraging, we would not be surprised if the Rand enjoyed some extended short-covering into the weekend. That being said, we still prefer to be fading rand rallies over the medium term as long as emerging market sentiment remains poor.’

Although the Rand’s downward trajectory has caused concern among some people, one industry expert recently argued that there is no cause for alarm as the Rand will bottom out soon.

Writing for Business Report, Pierre Heistein asserted that social and political circumstances will leave the Rand trading between 10 to 14 Rand to the Dollar for the next decade, but while the currency is likely to ‘stay in a relatively depreciated state’ it will not ‘tumble to catastrophic levels’.

Next week the Kagiso manufacturing PMI is the only piece of South African data to be aware of.

South Africa’s trade balance report may see the GBP/ZAR pairing fluctuate before the weekend, but in the days ahead GBP/ZAR movement is more likely to be driven by UK manufacturing/construction/services PMI for January, the Bank of England’s rate decision, UK trade balance figures, manufacturing/industrial production data and the NIESR GDP estimate for January.

Of course the US non-farm payrolls report, out next Friday, will also be responsible for market volatility.

If the world’s largest economy produces another disappointing employment report, emerging-market assets like the Rand could receive a little boost.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.6114,

,South African Rand,18.6114,

Euro, ,South African Rand,15.1524,

,South African Rand,15.1524,

US Dollar, ,South African Rand,11.2315 ,

,South African Rand,11.2315 ,

Australian Dollar, ,South African Rand,9.7370 ,

,South African Rand,9.7370 ,

New Zealand Dollar, ,South African Rand,9.2436,

,South African Rand,9.2436,

Canadian Dollar, ,South African Rand,9.9695,

,South African Rand,9.9695,

[/table]

Comments are closed.