The Rand began the local session in a stronger position against the majority of its most traded rivals as the appeal of emerging-market assets was boosted by Janet Yellen’s comments and upbeat trade data from China.

Yellen, the new chairman of the Federal Reserve, intimated that the central bank would be sticking with its slow and steady tapering of stimulus in the near future. Although Yellen also stressed that there is serious work to be done to improve the US labour sector, the fact that she refrained from delivering any serious surprises was beneficial for higher-risk assets like the Rand.

In the opinion of one New York-based economist; ‘It’s very obvious [Yellen’s] working from the same playbook as Bernanke. The Fed will continue to cut its bond purchases by $10 billion at each policy meeting the rest of the year.’

Meanwhile, during the Australasian session China published surprising strong trade data, detailing a 10.0 per cent annual surge in imports and a 10.6 per cent year-on-year gain in exports.

As China is the main buyer of South Africa’s raw materials the result brightened the latter nation’s economic outlook and boosted the Rand.

The expectation that today’s advance US retail sales report will show a stagnation in sales also helped the Rand achieve a two-week high against its US counterpart.

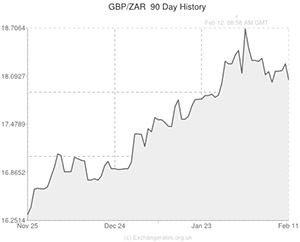

Meanwhile, over the course of European trading the Pound fluctuated against peers like the Rand as investors digested the Bank of England’s inflation report.

In the report growth projections for the UK were positively revised and inflation forecasts were lowered as a result of Pound strength and the expectation that utility prices won’t rise by as much as previously expected.

The prospect of a rate increase in 2015 was hinted at.

However, it wasn’t all good news as the BoE also stated that the outlook for British productivity was dimmer as the momentum seen last year faltered as 2014 got underway.

Sterling experienced extensive volatility in the wake of the report’s release, hitting highs of 18.1101 against the Rand and lows of 17.8693.

Yesterday the Rand was lifted by an unexpected decline in the South African unemployment rate and domestic news also had an impact today.

The news that retail sales in South Africa increased by more than expected in December, month-on-month, gave the Rand a further boost.

Sales were up 1.4 per cent in December, month-on-month, following a gain of 1.2 per cent in November.

Economists had expected sales to dip by 0.3 per cent.

On the year sales were up 3.5 per cent, less than the 4.2 per cent annual gain recorded in November.

While this week’s UK house price balance and construction output data could inspire further GBP/ZAR movement, investors will also be looking to Thursday’s South African mining production data for guidance.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.9485,

,South African Rand,17.9485,

Euro, ,South African Rand,14.9297,

,South African Rand,14.9297,

US Dollar, ,South African Rand,10.9520 ,

,South African Rand,10.9520 ,

Australian Dollar, ,South African Rand,9.9117,

,South African Rand,9.9117,

New Zealand Dollar, ,South African Rand,9.1863,

,South African Rand,9.1863,

Canadian Dollar, ,South African Rand,9.9417,

,South African Rand,9.9417,

[/table]

Comments are closed.