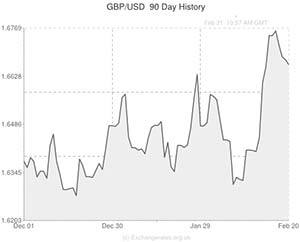

Sterling failed to breach 1.6700 against the US Dollar yesterday as a strong rebound in February’s US Manufacturing PMI boosted demand for the ‘Greenback’. Consequently, GBP/USD sunk to a weekly low of 1.6626.

The Manufacturing barometer rose by 3.0 points to a 3.5-year high of 56.7. The sharp jump in output, which was influenced by a huge backlog of work – the biggest on record – following January’s inclement weather, helped bring the indicator to its highest level since May 2010.

Although the reaction, in terms of US Dollar strength, was fairly delicate the positive result helps cement the prevailing attitude among markets that stimulus will continue to be slashed in coming months. On Wednesday night the Federal Reserve Minutes report showed that, unless a substantial decline in economic output was witnessed, the Fed would continue to taper its QE3 programme by around $10 billion per month.

Some analysts – those on the dovish side of the fence – had voiced concerns regarding the recent weather-related slowdown. They posited that if it were to continue for much longer it could constitute a ‘substantial’ decline in output.

However, with Manufacturing activity rebounding in February, it is likely that other indicators – most importantly those related to the labour market – will follow suit. This paves the way to more tapering, and subsequently a stronger US Dollar.

Other American data printed more neutrally; US Consumer Prices printed inline with the market consensus of 1.6% and Initial Jobless Claims fluctuated slightly lower from 339,000 to 336,000.

Back home in the United Kingdom economic developments favoured the Pound, but not in a significant way as to send GBP/USD higher.

The Confederation of British Industry (CBI) reported that its index of industrial trends rose to +3 in February, up from -2 in January and considerably higher than the long-running average of -17. Expectations for future performances are also riding high, with 16 out of the 17 Manufacturing Sectors predicted to see growth over the next three months.

The Pound was also buoyed by comments from Bank of England policymaker Martin Weale, confirming that interest rates will probably start to rise in the spring of 2015. The BoE Quarterly Inflation report featured literature and graphs suggesting as much last week, but this was the first time that the potential for a Q2 2015 rate hike was expressed verbally by a policymaker from the Bank; this gave Sterling a mild boost.

Comments are closed.