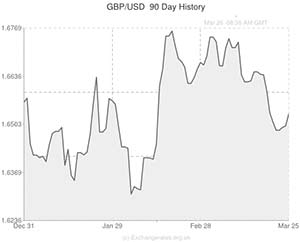

While Sterling looks set to end the local session in a stronger position against the ‘Greenback’, after the publication of US durable goods orders and services data the GBP to USD exchange rate trimmed earlier gains.

Over the course of European trading the Pound posted its most significant advance against the Euro for five days and strengthened against the US Dollar in response to Bank of England Policy Maker Martin Weale’s comments.

Weale hinted that interest rates will be increased as the UK economy returns to normal.

He also offered a fairly upbeat assessment of the UK’s economic performance, a factor which lent the Pound additional support.

However, Sterling trimmed its advance against the ‘Greenback’ following the release of influential US economic reports.

Firstly US durable goods orders were shown to have increased by 2.2 per cent in February following a negatively revised decline of 1.3 per cent in January.

Economists had been expecting an increase of 0.8 per cent.

Durables excluding transportation increased by 0.2 per cent in February, less than the 0.3 per cent increase expected.

This report was swiftly pursued by the Markit flash US services PMI, which advanced from February’s fourth-month low of 53.3 to 55.5 this month.

Economists had forecast a reading of 54.0 for March.

Although new business rose at its slowest pace for 16 months, the sector expanded solidly.

In a statement issued with the figures Markit economist Chris Williamson observed; ‘Service sector activity rebounded in March after a weather-torn February, but the survey is clearly flashing some warning lights as to whether the economy has lost some underlying momentum and that growth could slow in the second quarter.’

Williamson asserted that the easing in new business creation was perhaps the most worrying element, concluding that ‘The question policymakers need the answer to is whether this weakness still reflects some weather impact. Companies certainly expect conditions to improve. Firms’ expectations about the year ahead picked up in March and are running above the average seen last year. Until a clearer picture emerges, it seems likely that policy stimulus will continue to be eased back.’

Composite PMI for the world’s largest economy came in at 55.8, up from 54.1 the previous month. Separate figures showed that US MBA mortgage applications fell by 3.5 per cent in the week ending March 21st following a positively revised gain of 0.2 per cent the previous week.

The Pound remained slightly stronger against its US counterpart after the reports were published.

According to some industry experts, Dollar bulls are waiting for economic data to justify the Federal Reserve’s decision to continue with the steady tapering of stimulus.

Tomorrow’s UK retail sales report may inspire GBP/USD fluctuations but investors will also be paying close attention to US growth figures and initial jobless claims data.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.6044,

,Pound Sterling,0.6044,

US Dollar, ,Canadian Dollar,1.1156,

,Canadian Dollar,1.1156,

US Dollar, ,Euro,0.7252,

,Euro,0.7252,

US Dollar, ,Australian Dollar,1.1094,

,Australian Dollar,1.1094,

US Dollar, ,New Zealand Dollar,1.1618 ,

,New Zealand Dollar,1.1618 ,

Canadian Dollar, ,US Dollar ,0.8964,

,US Dollar ,0.8964,

Pound Sterling, ,US Dollar,1.6548 ,

,US Dollar,1.6548 ,

Euro, ,US Dollar,1.3794,

,US Dollar,1.3794,

Australian Dollar, ,US Dollar,0.9233,

,US Dollar,0.9233,

New Zealand Dollar, ,US Dollar,0.8612 ,

,US Dollar,0.8612 ,

[/table]

Comments are closed.