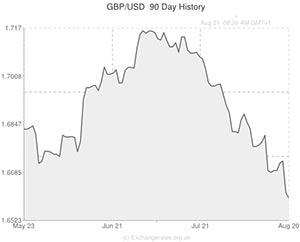

The Pound to US Dollar exchange rate (GBP/USD) weakened to 1.6600 last night when the Federal Reserve released the minutes from August’s Federal Open Market Committee meeting.

The FOMC report showed that policymakers at the central bank were becoming more optimistic with regards to the health of the US economy. Policymakers agreed that labour market conditions and the general state of the economy had improved by more-than-anticipated over the past year and hinted that interest rates could rise in the foreseeable future if this positive momentum continues.

‘Many participants noted that if convergence toward the committee’s objectives occurred more quickly-than-expected, it might become appropriate to begin removing monetary policy accommodation sooner than they currently anticipated”.

The hawkish remarks bolstered the appeal of the ‘Greenback’ as traders priced in the possibility of higher interest rates in the US economy.

Sterling had risen by around half a cent against the US Dollar from 1.6600 to 1.6650 yesterday morning as investors reacted to the Bank of England’s latest minutes report.

The BoE literature revealed that for the first time in three years August’s interest rate vote did not yield a unanimous decision. Two policymakers, Martin Weale and Ian McCafferty, voted for a rate hike leaving the vote at 7-2 in favour of maintaining the current record low 0.50% benchmark rate.

Weale and McCcafferty argued that a significant degree of slack in the British economy had been eroded since the start of the year and cited the rapidly declining unemployment rate and sturdy second quarter GDP numbers as reasons to start tightening monetary policy as soon as possible.

However, the majority of the nine-person Monetary Policy Committee (MPC) agreed that it was prudent to wait for wage growth to accelerate before putting further pressure on British households, which could potentially strangle the UK economic revival. The minutes also showed that policymakers were concerned with the lack of meaningful growth in the Eurozone, which is Britain’s biggest trading partner. Geopolitical concerns primarily related to the situation in eastern Ukraine were also mentioned as reasons to remain in wait-and-see mode.

It is also worth mentioning that the August BoE vote took place before Tuesday’s CPI data showed that inflation slowed from 1.9% to 1.6% in Britain during July. This means that it is possible that Weale and McCafferty will retract their hike votes in September.

In light of the topsy-turvy week for rate hike speculation, which included an extremely soft UK average earnings print, a dovish BoE quarterly inflation report, a hawkish sounding statement from Governor Mark Carney, a disappointing CPI inflation reading and yesterday’s surprise BoE minutes, traders now estimate that the bank’s first rate increase will come in January 2015. Prior to the minutes, analysts had pencilled the first hike in for February 2015.

Pound to US Dollar Exchange Rate (GBP/USD) Softens after Poor UK Retail Sales

Yesterday saw a reversal in fortune for Sterling compared to Wednesday. UK Retail Sales appreciated by 0.5% in July, but the yearly figure grew below the forecast percentage of 3.5%; resulting in stunted growth at 3.4%.

A string of negative Eurozone domestic data results also contributed to a weakening Pound. Eurozone Composite, Manufacturing and Services PMI’s all fell below forecasts. Also Consumer Confidence was seen to plunge well below expectations; posting a -10.0 from the previous figure of -8.4.

In complete contrast US domestic data churned out positive result after positive result. US labour market data outlined the continued improvement and sparked speculation of an interest rate hike in the near future.

Comments are closed.