On Thursday the Rand was holding its own against the US Dollar in spite of yesterday’s less-than-encouraging trade data for South Africa.

The report showed that the nation’s trade deficit widened considerably more than anticipated thanks to the platinum sector strike playing havoc with output and export levels.

While the Rand fluctuated modestly in the aftermath of the report’s publication it recovered ground against the US Dollar.

In the view of one local trader; ‘The Rand held up today because of Workers’ Day [a national holiday] tomorrow, nobody wanted to do anything much. But that trade number is worrying in terms of our balance of payments.’

The Rand’s advance against the US Dollar was aided by the news that the US economy expanded only fractionally in the first quarter of the year.

Although the worse-than-anticipated growth report was almost wholly attributed to the horrific weather, the result still softened the ‘Greenback’.

The US Dollar edged lower still after the Federal Open Market Committee policy announcement. The Fed tapered stimulus, as expected, but argued that interest rates need to remain at record lows.

After the FOMC decision and the US Dollar’s slide currency strategist Brian Dangerfield asserted; ‘The Fed overall is still very Dovish as an institution and kept its forward guidance on the Fed funds rate unchanged. After the Fed made a myriad of changes in their March statement, everyone always expected the April statement would be a lot less exciting.’

Emerging market currencies like the Rand also benefited from the fact that a gauge of currency volatility declined.

Over the course of European trading on Thursday the USD/ZAR pairing fluctuated, but the Rand ultimately came out on top as the news that more Americans than expected filed for unemployment benefits in the week ending April 26th put further pressure on the ‘Greenback’.

That being said, separate figures showed a 0.5 per cent increase in US personal income in March (rather than the 0.4 per cent expected) and a 0.9 per cent advance in personal spending.

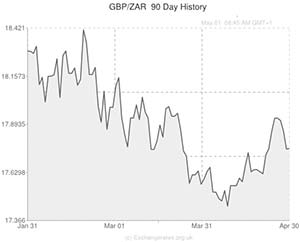

The Rand’s relationship with the Pound was less impressive on Thursday as the British asset broadly strengthened following the publication of upbeat UK manufacturing figures.

The pace of expansion in the UK manufacturing sector was expected to have slowed in April, with the measure declining from 55.8 to 55.4, but it actually climbed to 57.3 – indicating that the UK got off to a solid start as the second quarter of the year began.

South Africa’s KAGISO manufacturing PMI could be a catalyst for GBP/ZAR fluctuations tomorrow, as could UK construction data.

Of course investors will also be paying close attention to the week’s most influential data – US non-farm payrolls figures.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.7412,

,South African Rand,17.7412,

Euro, ,South African Rand,14.5046 ,

,South African Rand,14.5046 ,

US Dollar, ,South African Rand,10.4904,

,South African Rand,10.4904,

Australian Dollar, ,South African Rand,9.7359,

,South African Rand,9.7359,

New Zealand Dollar, ,South African Rand,8.9782,

,South African Rand,8.9782,

Canadian Dollar, ,South African Rand,9.6037,

,South African Rand,9.6037,

[/table]

Comments are closed.