The Pound retained strength against the Euro yesterday but ceded some ground against the US Dollar, Australian Dollar and New Zealand Dollar as a number of high profile manufacturing PMI reports were released over the newswires.

‘Sick man of Europe’ drags PMI score down

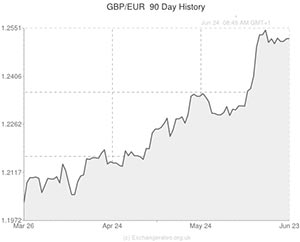

The Sterling to Euro exchange rate (GBP/EUR) reached a daily high of 1.2535 yesterday as markets reacted to the latest set of Eurozone PMI numbers.

Markit Economics reported that their headline measure of private sector output slowed from 53.5 to a 6-month low of 52.8 in June. The disappointing Eurozone composite index reflected another month of weakness in the bloc’s second largest economy. France, the so-called ‘sick man of Europe’, saw manufacturing output sink from 49.6 to 47.8 and service sector activity shrink from 49.1 to 48.2. The region’s most industrious economy, Germany, also saw output decelerate; the composite German PMI fell from 55.6 to an 8-month low of 54.2.

The latest lacklustre Eurozone indicators heaped more pressure on policymakers at the European Central Bank to bolster its stimulus scheme with a quantitative easing-style bond-buying programme. This slight increase in ECB stimulus bets weighed on demand for the single currency.

4-Year high US manufacturing print augurs well for Q2 GDP

The Pound to US Dollar exchange rate (GBP/USD) fell to a daily low of 1.7002 yesterday as the latest manufacturing report from Markit showed that factory output hit a 4-month high during June.

The stronger-than-anticipated rise in the headline figure from 56.4 to 57.5 was influenced by robust readings for new orders, total output and job creation, which bodes well for second quarter growth in the US. It is now estimated that the world’s largest economy will expand by at least 3.0% in Q2.

However, GBP/USD remained above significant psychological support at 1.7000 as traders appeared reluctant to buy into the ‘Greenback’ following last week’s dovish policy statement from Federal Reserve Chairwoman Janet Yellen. With the Fed Chief adamant that rates won’t rise anytime soon – even after QE3 has been fully wound down – there is a strong possibility that Sterling could maintain its 1.5-year high exchange rate versus the US Dollar.

Flaming Chinese dragon stokes demand for ‘Aussie’ & ‘Kiwi’

Demand for the high-yielding Australian and New Zealand Dollars picked up remarkably yesterday as markets reacted to a surprisingly robust Chinese PMI report. HSBC announced that Chinese manufacturing output rebounded from a contraction of 49.4 to register an expansion of 50.8 during June.

The robust reading, which beat forecasts of 49.7, caused both the ‘Aussie’ and the ‘Kiwi’ to rally versus the Pound yesterday as traders adjusted their projections for Chinese imports. China buys more goods from Australia and New Zealand than any other country in the world, and as such Chinese growth prospects have a profound impact on export growth in the Antipodean nations. If China looks to be on a strong path then it is likely that Chinese firms will purchase large amounts of goods from Australia and New Zealand; this translates into enhanced demand for AUD and NZD.

Updated 11:00 GMT 24 June 2014

Pound Flounders as BoE Retracts Hawkish Comments

The Pound exchange rate broadly softened as trading continued on Tuesday and several high profile Bank of England officials issued provocative comments regarding the timeline for increasing interest rates.

The GBP/EUR, GBP/USD, GBP/AUD and GBP/NZD exchange rates all fell as investors reacted to dovish comments from Monetary Policy Committee members Charlie Bean and David Miles.

BoE Governor Mark Carney also went backwards on previous statements and intimated that softer-than-forecast wage gains could make it necessary to keep interest rates at record lows for the foreseeable future.

After Carney asserted that borrowing costs could be increased sooner than currently anticipated, the Pound surged above 1.25 against the Euro and hit a five and a half year high against the US Dollar. His latest remarks have had the opposite effect and pushed the Pound lower. If this week’s UK data releases fail to meet or exceed estimated levels the Pound (GBP) exchange rate could remain in a weaker position against the Euro (EUR) and US Dollar (USD).

Updated 15:55 GMT 24 June 2014

US Data lends US Dollar Support

The Pound Exchange rate remained weaker against the US Dollar as the USD was bolstered by domestic reports showing an improvement in US consumer confidence and home sales.

The US Consumer Confidence gauge rose from a negatively revised 82.2 in May to 85.2 in June. A reading of 83.5 had been anticipated. Meanwhile, New Home Sales in the US were up by 18.6% – the most considerable increase for 20 years and a far stronger jump than the 1.6% increase anticipated.

The Pound is likely to continue trending below technical resistance of 1.70 against the US Dollar overnight. Tomorrow’s UK CBI reported sales report could boost the Pound if it shows the increase from 16 to 23 anticipated.

Updated 09:40 GMT 25 June 2014

The Pound (GBP) was struggling to regain a firmer footing against peers like the Euro (EUR) and US Dollar (USD) as the remarks issued yesterday by Bank of England officials (including Governor Mark Carney) saw bets for an interest rate increase occurring this year plummet.

The Pound (GBP) exchange rate is currently trading 0.11% lower against the Euro and is holding steady against the US Dollar having fallen below technical resistance of 1.70 yesterday.

While the US Dollar (USD) garnered support from some better-than-forecast US reports, including a strong Consumer Confidence index, geopolitical tensions did inspire currency market movement overnight.

The Euro (EUR) was bolstered on Wednesday as the German GfK Consumer Confidence survey produced a reading of 8.9 in July, stronger than the reading of 8.6 forecast by economists and up from a positively revised figure of 8.6 in June.

While UK news is fairly thin on the ground today, the Confederation of British Industry’s Reported Sales figure could have a modest impact on the Pound (GBP) exchange rate. The figure is expected to have risen from 16 in May to 23 in June.

Comments are closed.