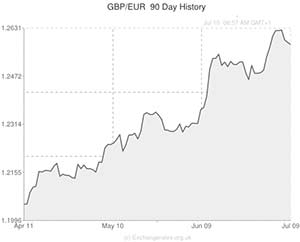

Shortly after Thursday’s European trading session began, the Pound to Euro (GBP/EUR) exchange rate shed almost 0.2% as investors responded to the UK’s disappointing Trade Balance report. The trade figures showed that a less-than-impressive 0.6% increase in exports caused the UK’s deficit widen to 9.20 billion Pounds in May.

This was up from a deficit of 8.81 billion Pounds the previous month and was the widest deficit for four months.

Domestic imports were up 1.7%.

The result was largely due to a spike in the importing of aircraft.

On a seasonally adjusted basis, the UK’s goods and services deficit climbed from 2.1 billion Pounds in April to 2.4 billion Pounds in May.

In the three months to May (a timeframe which provides a less volatile reading), the goods trade deficit came in at 26.31 billion Pounds – ever so slightly wider.

The GBP to USD exchange rate went on to shed any gains accrued in the wake of the release of Federal Open Market Committee meeting minutes.

In the immediate aftermath of the FOMC minutes publication the Pound advanced to a high of 1.7168 against the US Dollar. However, Sterling has since dropped by 0.25% against its safe-haven rival.

The GBP to Euro pairing hit a low of 1.2546.

As investors are envisaging no surprises, it is unlikely that the Pound to Euro exchange rate will experience much movement following the Bank of England’s rate decision.

However, according to some industry experts the accord which has (up to now) been upheld within the Monetary Policy Committee regarding the timeline for increasing interest rates could be about to end.

In the view of economist Rob Wood; ‘The bank will have to move to a more neutral level of interest rates at some point and some of the voters think that process should start sooner. This could well be the last decision that is unanimous for a while.’

Some strategists have pegged August (and the release of the UK inflation report) as the time for some deviation in interest rate opinions among policy makers.

The BoE is expected to leave the benchmark interest rate at a record low of 0.5% and the level of asset purchases unchanged. A bland announcement of this kind would have little impact on the Pound.

Tomorrow there will be two main causes for volatility in the Pound to Euro exchange rate.

Germany’s final inflation figures for June could have an impact if they are revised, and if the UK’s construction output report prints positively Sterling could rally.

Fluctuations in the GBP to USD pairing, meanwhile, are most likely to occur as a result of US Initial Jobless Claims figures and tomorrow’s US Monthly Budget Report.

UPDATED: 09:00 GMT 11 July, 2014

Portuguese News Limits Euro Appeal, Pound Movement Expected

The Pound to Euro (GBP/EUR) exchange rate was trading in the region of 1.2588 after a slightly volatile session on Thursday.

While Sterling slipped against the Common Currency in response to unimpressive trade balance data from the UK, closer analysis of the figures showed that the weakness was derived from reduced demand from the Eurozone.

The appeal of the Euro was also called into question after a Portuguese banking situation brought back memories of the currency bloc’s protracted economic crisis.

This morning final German inflation figures confirmed that the nation’s Consumer Price Index increased by 1.0% in June on a year-on-year basis.

With UK Construction Output figures due out soon further Pound to Euro (GBP/EUR) exchange rate movement could occur.

As it stands, the GBP to USD pairing is trending in a slightly stronger position. If today’s UK data yields positive results the Pound could advance on the ‘Greenback’.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.7118,

,US Dollar,1.7118,

Pound Sterling, ,Euro,1.2560,

,Euro,1.2560,

Pound Sterling, ,Australian Dollar,1.8286,

,Australian Dollar,1.8286,

Pound Sterling, ,New Zealand Dollar,1.9417,

,New Zealand Dollar,1.9417,

US Dollar, ,Pound Sterling,0.5836,

,Pound Sterling,0.5836,

Euro, ,Pound Sterling,0.7962,

,Pound Sterling,0.7962,

Australian Dollar, ,Pound Sterling,0.5473,

,Pound Sterling,0.5473,

New Zealand Dollar, ,Pound Sterling,0.5145,

,Pound Sterling,0.5145,

[/table]

Comments are closed.