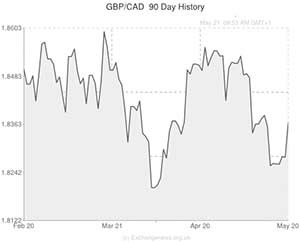

As the week continued the GBP to CAD pairing edged slightly higher.

On Monday the Pound to Canadian Dollar exchange rate was trading in a narrow range as limited economic news restrained currency market movement.

However, with UK inflation figures increasing speculation surrounding a Bank of England interest rate hike on Tuesday, Sterling was able to advance on its Canadian rival.

While economists had expected an annual consumer price increase of 1.7 per cent, prices actually advanced by 1.8 per cent in April year-on-year.

The increase was the first for ten months, although economists did attribute the gain to the Easter break being in April rather than March.

The core inflation rate came in at 2.0 per cent.

The Pound posted widespread gains after the report was published and economist Howard Archer noted; ‘It still looks highly probably that earnings growth will increasingly move above inflation over the coming months thereby lifting consumers’ purchasing power.’

During North American trading the ‘Loonie’ was negatively impacted by a risk-averse shift in the market and fluctuating commodity prices.

Investors remained slightly wary of higher-risk currencies as the instability in Ukraine and Vietnam persisted.

The Canadian Dollar also declined as domestic wholesale sales dropped from a record high.

Wholesale sales slipped by 0.4 per cent in March, month-on-month, rather than rising the 0.4 per cent expected.

This followed a 1.1 per cent gain in February.

The figures compiled by Statistics Canada showed a 1.4 per cent drop in machinery and equipment and a 3.0 per cent decline in motor vehicles/parts.

With Canadian economic news lacking tomorrow, movement in the GBP to CAD pairing will be the result of the UK’s retail sales report and the release of minutes from the latest Bank of England policy meeting.

Investors will also be looking ahead to Thursday and Canada’s own retail sales report.

Investors have forecast a sales increase of 0.3 per cent in March, month-on-month. Anything stronger than that could boost the ‘Loonie’.

Canadian Dollar to US Dollar (CAD/USD) Exchange Rate slips to one-week low

The Canadian Dollar eased to its lowest level in a week against its US relation as investors await the release of minutes for the Federal Reserve’s latest policy meeting.

Investors will be looking at the minutes closely for any signs that would suggest that the Fed’s policy makers could be considering increasing the world’s largest economy’s interest rate.

A rate hike is unlikely after New York Federal Reserve President William Dudley reiterated the Central Bank;s dovish stance by saying that the pace of rate hikes is likely to be ‘slow’.

The ‘Loonie’ was stronger against the weakened Euro but was weaker against the Pound.

Comments are closed.