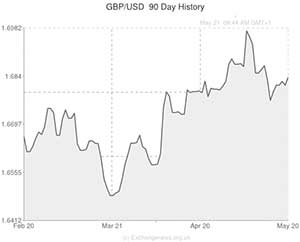

The Pound to US Dollar exchange rate (GBP/USD) grew by around a third of a cent during yesterday’s session as investors reacted to a surprise 0.2% rise in the annual UK consumer price index.

Beating analysts’ predictions of 1.7% the headline inflation barometer jumped from March’s 4-year low of 1.6% to 1.8%. The result marked the first time in ten months that CPI has actually grown.

Sterling shot up against the US Dollar from 1.6810 to 1.6864 in a kneejerk response to the report as traders brought forward their projections for the Bank of England’s first interest rate hike.

However, GBP/USD fell back slightly to 1.6840 soon after as investors realised that the outperforming inflation result was heavily influenced by the late Easter holiday. Last year Easter fell in March but this year the holiday took place in April, which meant that April’s CPI featured a surge in transport costs due to airlines and ferry operators upping their prices.

By the time of the opening bell on the New York Stock Exchange economists had already concluded that the Bank of England would not start its hiking cycle any sooner due to the 1.8% CPI print. Subsequently, GBP/USD remained fairly flat during the North American session.

During the evening New York Federal Reserve President William Dudley told markets that even when the US central bank does start raising interest rates it will not be in a hurry to bring the benchmark rate back up to the historical average of 4.25%.

Speaking to the New York Association for Business Economics, Dudley said there would be “a considerable period of time” between the end of the QE3 scheme and the first rate hike. He also stated that the pace of the hiking cycle would “probably be relatively slow” and intimated that the benchmark rate would likely rest “well below” the long-running average of 4.25%.

Dudley’s dovish comments did not have a massive impact on the US Dollar because Fed Chair Janet Yellen has already made it clear that the bank has a dovish bias at the moment.

Later this morning the Bank of England will release the minutes from its latest meeting. The central bank literature is likely to show that Mark Carney and his nine-man committee are still concerned with the level of slack in the UK economy – despite last week’s impressive labour market report which saw the headline unemployment rate fall to 6.8%. If the report strikes a dovish tone it could weigh on demand for the Pound. On the other hand, any indication that some members of the MPC are willing to start raising rates before the end of the year would be seen as a bullish signal for Sterling.

During the evening the Federal Reserve is set to release the minutes from its own policy meeting. The report may be quietly received as long as there are no surprises. Dovish commentary is expected, so it would either take a very negative set of comments or a surprisingly positive outlook to have a significant impact on the Pound to US Dollar exchange rate (GBP/USD).

Comments are closed.