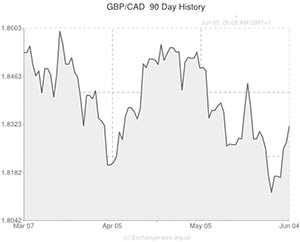

Yesterday the GBP to CAD exchange rate surged in response to a dovish policy statement from the Bank of Canada.

The central bank left policy unaltered and refrained from offering any indication of when rates might be altered or what direction they might take.

The Bank of Canada also reiterated concerns regarding the country’s low level of inflation.

BOC Governor Stephen Poloz noted that weak exports and the strength of the domestic currency are hindering domestic growth.

His words pushed the GBP/CAD pairing higher and helped the USD/CAD pairing achieve a multi-month best.

After the policy decision was delivered economist Emanuella Enenajor observed; ‘As long as the economy is soft, and as long as there’s uncertainty about US growth, and as long as exports remain tepid, I think the Bank of Canada is going to be very careful not to say or do anything to trigger a strengthening in the currency. The bank is likely to err on the side of caution.’

Meanwhile, the Pound was supported as a gauge of UK house prices revealed a surge in prices in May and the Bank of England opted to leave fiscal policy unaltered at its latest policy meeting.

As economists expected, the BoE left the benchmark interest rate at a record low of 0.5 per cent and stuck to the previous asset purchase target of 375 billion Pounds.

The appeal of the Canadian Dollar was dented further on Thursday as Canada’s building permits report showed a much smaller increase than anticipated. Building permits increased by just 1.1 per cent in April, month-on-month, and not the 4.2 per cent expected.

March’s figure was negatively revised to a decline of 3.2 per cent.

Later in North American trading Canada’s Ivey Purchasing Managers Index was released.

The gauge held above the 50 mark separating growth from contraction but slid from 54.1 in April to 52.2 in May.

However, while the ‘Loonie’ was softer against the US Dollar and Pound, the commodity-driven currency was able to advance on the Euro after the European Central Bank announced that it would be adopting historic stimulus measures in order to shore up the Eurozone’s economic recovery.

Before the weekend the GBP/CAD pairing could encounter considerably more volatility due to the release of UK trade figures and Canadian employment data.

Tomorrow’s employment report is expected to show that the Canadian economy added 21,500 positions in May and that the unemployment rate held at 6.9 per cent.

The US non-farm payrolls report is also likely to impact currency market movement.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5449,

,Pound Sterling,0.5449,

Canadian Dollar, ,US Dollar,0.9142,

,US Dollar,0.9142,

Canadian Dollar, ,Euro,0.6736,

,Euro,0.6736,

Canadian Dollar, ,Australian Dollar,0.9822,

,Australian Dollar,0.9822,

Canadian Dollar, ,New Zealand Dollar,1.0877,

,New Zealand Dollar,1.0877,

US Dollar, ,Canadian Dollar ,1.0930,

,Canadian Dollar ,1.0930,

Pound Sterling, ,Canadian Dollar,1.8321,

,Canadian Dollar,1.8321,

Euro, ,Canadian Dollar,1.4833,

,Canadian Dollar,1.4833,

Australian Dollar, ,Canadian Dollar,1.0181,

,Canadian Dollar,1.0181,

New Zealand Dollar, ,Canadian Dollar,0.9194,

,Canadian Dollar,0.9194,

[/table]

Comments are closed.