The Pound, US Dollar and other major peers all surged against the Euro on Thursday after the European Central Bank took action to stave off the threat of inflation and bolster growth in the region’s economy.

The ECB lowered its benchmark interest rate from 0.25% to a new record low level of 0.15% and took the unprecedented step of introducing a negative bank rate.

The ECB is the first of the world’s major central banks to make such a move.

The negative deposit rate will now mean that the regions commercial banks will have to pay to store money with the Central Bank instead of receiving interest.

It is hoped that the measure will encourage banks to lend more and in turn assist the regional economy.

According to Reuters, Conservative German economist Hans-Werner Sinn of the Ifo institute said that the ECB’s moves smacked of desperation and would not work.

“This is a desperate attempt, with ever cheaper money and penalty rates on deposits, to shift capital flows to southern Europe in order to stimulate growth there,” he said.

Also announced today was the introduction of a new targeted long-term refinancing operation (LTRO).

The measure is designed to help banks lend to smaller businesses and help the ‘real economy’.

€400 billion will be made available.

“We decided on a combination of measures to provide additional monetary policy accommodation and to support lending to the real economy. I am confident that the measures announced today will help drive inflation to 2% over the medium term,” said ECB President Mario Draghi in the Press conference that followed the rate decision.

The ECB also revised its economic forecasts for the coming year. It now forecasts that the region will see economic growth of just 1.0% this year, down from its previous forecast of 1.2%.

For next year the Central Bank now expects growth of 1.7%, a slight revision upwards from the previous figure of 1.5%.

Draghi told reporters that the ECB was prepared to take further action to tackle the risks to the Eurozone economy.

“If required, we will act swiftly with further monetary policy easing. The governing council is unanimous in its commitment to use unconventional instruments if needed to further address risks of too prolonged a period of low inflation,” Mr Draghi said.

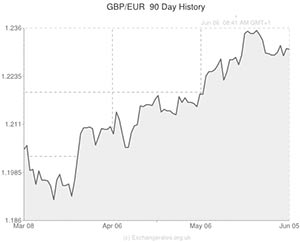

In the aftermath of the measures and rate cut being announced the Euro fell against all of its peers and declined to a four-month low against the US Dollar.

Euro to Pound Update – 06/06/14

The Euro regained some of yesterday’s losses against the Pound but remains under pressure as the week draws to a close.

Following yesterday’s policy meeting announcements from the European Central Bank the Euro tumbled to its lowest level in two years against Sterling.

Overnight the single currency recovered slightly as economists digested the outcome of the meeting which saw interest rates cut, the ECB’s deposit rate slashed to below zero and the introduction of a €400 billion Longer Term Refinancing operation.

The Euro looks set to remain under pressure for the foreseeable future as economists will be waiting to see whether the measures announced on Thursday will make a difference to the struggling Eurozone economy.

Further gains for the Pound were restrained on Friday after a report released by the Office for National Statistics showed that the UK’s trade balance fell more than expected last month.

The UK’s trade balance fell to a seasonally adjusted -£8.92 billion from the previous months figure of -£8.29 billion. Analysts had expected U.K. trade balance to fall to -£8.65 billion last month.

Comments are closed.