The data calendar points towards a continuation of the Pound Sterling’s recent strength versus its major currency peers this week.

British manufacturing production is predicted to print at 5.6% on Tuesday morning and the Bank of England is set to refrain from loosening monetary policy further on Thursday. Both of these indicators are liable to support further gains for the Sterling currency.

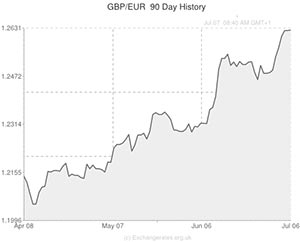

GBP/EUR

The Pound to Euro exchange rate (GBP/EUR) is currently trading close to a 21-month high of 1.2628 due to bets that monetary policy will tighten in Britain and loosen in Europe over the next six months.

Last week the European Central Bank hinted that it is considering how to implement a QE-style bond-buying programme to help drive consumer prices back towards the 2.0% target in the currency bloc. This weakened demand for the single currency because it raises the prospect of reduced yield values on Eurozone sovereign bonds.

There is nothing on the calendar that looks supportive to the single currency and as such GBP/EUR looks set to trade higher towards 1.2700 during this week’s session.

GBP/USD

The Pound to US Dollar exchange rate (GBP/USD) is currently trading in around a 5.5-year high of 1.7175 despite the fact that the US unemployment rate sunk to a 5-year low of 6.1% last week.

Demand for the ‘Greenback’ failed to accelerate versus Sterling last week even though US non-farm payrolls posted a surprisingly strong 288,000 score for June. This is because Federal Reserve Chairwoman Janet Yellen has repeatedly stated that she is determined to keep interest rates at record lows for a considerable amount of time, even after the QE3 programme has been fully wound down.

If the latest Fed minutes, to be released on Wednesday evening, strike a dovish tone then it is entirely likely that GBP/USD could trade towards a fresh 2008 high at 1.7200 later this week.

GBP/CAD

The only key event on the Canadian economic calendar this week is the unemployment report on Friday. The headline jobless rate is predicted to remain at 7.0% but the economy is expected to add a further 24,000 workers to the payroll. Barring any surprises, the data is likely to be viewed as neutral for the commodity-sensitive Canadian Dollar.

The sturdy outlook for the Pound could help drive the Sterling to Canadian Dollar exchange rate (GBP/CAD) back above 1.8300.

GBP/AUD

The Australian Dollar nosedived last week as Reserve Bank of Australia Governor Glenn Stevens indicated that the overvalued domestic currency could lead to another set of interest rate cuts. The surprisingly dovish remarks sent GBP/AUD rallying from 1.8140 to 1.8325.

RBA rate cut bets are likely to proliferate on Thursday if the Australian unemployment rate jumps from 5.8% to 5.9% as expected. A rise in joblessness could drive GBP/AUD to a fresh 4-month high of 1.8425.

GBP/NZD

Sterling trended slowly higher against the New Zealand Dollar last week and this process looks set to continue this week as British data maintains the Pound’s bullish momentum.

GBP/NZD is likely to rally towards a fresh monthly high of 1.9730.

UPDATED 12:25 GMT 7 July, 2014

Pound Sterling Exchange Rate (GBP) Slides Slightly

While the Pound Sterling exchange rate (GBP) got off to a fairly steady start to the week (trading in the region of a 21-month high against the Euro and an over five-year high against the US Dollar) the British asset went on to pare gains against its US counterpart.

Speculation surrounding the prospect of the Bank of England increasing interest rates before next year has bolstered the Pound in recent weeks, but now some industry experts are betting that the currency has been overbought.

In the view of industry expert Jim McCormick, ‘Against the Dollar we’re probably about as far as we’re going to go because the risk here is the Fed’s going to have to start raising rates as well’.

This morning the Pound Sterling exchange rate (GBP) shed 0.2% against the US Dollar.

However, if this week’s influential UK fundamentals impress, the Pound could still eke out some gains against the ‘Greenback’ over the next five days.

UPDATED 07:40 08 July, 2014

German Trade Data helps Pound Sterling Exchange Rate (GBP) Gain

On Tuesday morning the Pound was able to strengthen against the Euro ad German trade figures disappointed expectations.

Exports in the Eurozone’s largest economy were shown to have fallen by -1.1% in May month-on-month rather than the more modest decline of -0.4% forecast.

Imports were also shown to have fallen by -3.4% rather than climbing the 0.5% anticipated.

Further Pound Sterling exchange rate (GBP) movement can be expected to occur following the release of UK Manufacturing/Industrial Production and growth figures.

Comments are closed.