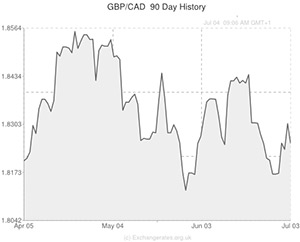

At the close of the week a dearth of news from the UK and Canada left the Pound to Canadian Dollar (GBP/CAD) exchange rate little changed.

The GBP to CAD pairing softened slightly on Thursday as a variety of factors came into play.

For starters, the appeal of the Pound was compromised by a below-forecast UK Services PMI figure.

The services gauge had been expected to produce a reading of 58.3 in June (following 58.6 in May) but it actually came in at 57.7.

This report certainly demonstrates the resilience of the UK’s economic recovery, but it came as a blow to investors who have become used to reports exceeding expectations.

There were notable positives to be drawn from the report, such as the impressive surge in employment in the sector. Markit stated; ‘Payroll numbers have now been rising for 18 months in a row, with growth in part underpinned by positive projections for activity. Despite easing to the lowest since last November, business confidence remained high during June amid forecasts of sustained demand improvements and hoped for returns on capital investment.’

Although the result is unlikely to dissuade the Bank of England from introducing higher interest rates in November, as many industry experts are betting they will, the Pound did lose ground against several of its rivals after the Services and Composite PMI figures were published.

The Canadian Dollar, meanwhile, was pushing a little higher on the back of better-than-forecast local manufacturing figures and comparatively positive Canadian trade data.

Canada’s trade report showed that the nation’s deficit shrank by more than economists had expected in April thanks to a climb in exports.

Ironically, automobiles were the main goods responsible for driving the rise in exports. Energy products also contributed.

Chief economist Douglas Porter said of the data; ‘This is a modestly encouraging report. It looks as if trade is beginning to help out a little bit [but] I think there’s a lot of room for improvement.’

As Canada is a commodity-driven nation, this week’s upbeat Chinese Manufacturing and Services PMI reports were also ‘Loonie’ positive.

That being said, fluctuating Brent crude oil prices did restrain the Canadian Dollar’s movement somewhat and the US employment figures also affected the currency’s exchange rate.

Next week several influential economic reports could be responsible for Pound to Canadian Dollar (GBP/CAD) volatility.

Reports to be particularly aware of include; Canada’s Ivey PMI and Building Permits figures, UK Industrial/Manufacturing Production data, the NIESR GDP estimate for June, Canadian Housing Starts, UK Trade Balance figures, Canada’s New Housing Price Index, Canadian Unemployment Rate and UK Construction Output.

If next week’s UK reports add to the case for the Bank of England hiking interest rates in November, the Pound’s bullish relationship with its peers is likely to continue and the Pound to Canadian Dollar (GBP/CAD) exchange rate could climb.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5483,

,Pound Sterling,0.5483,

Canadian Dollar, ,US Dollar,0.9407,

,US Dollar,0.9407,

Canadian Dollar, ,Euro,0.6920,

,Euro,0.6920,

Canadian Dollar, ,Australian Dollar,1.0053,

,Australian Dollar,1.0053,

Canadian Dollar, ,New Zealand Dollar,1.0734,

,New Zealand Dollar,1.0734,

US Dollar, ,Canadian Dollar ,1.0633,

,Canadian Dollar ,1.0633,

Pound Sterling, ,Canadian Dollar,1.8236,

,Canadian Dollar,1.8236,

Euro, ,Canadian Dollar,1.4447,

,Canadian Dollar,1.4447,

Australian Dollar, ,Canadian Dollar,0.9946,

,Canadian Dollar,0.9946,

New Zealand Dollar, ,Canadian Dollar,0.9288,

,Canadian Dollar,0.9288,

[/table]

Comments are closed.