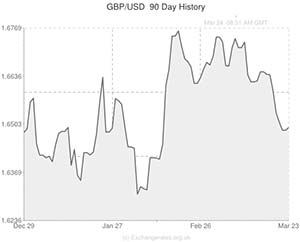

The Pound firmed against the US Dollar on Monday afternoon following the release of a US manufacturing PMI report which came in below economist expectations.

According to Markit’s flash Manufacturing Purchasing Managers Index (PMI) for the US, manufacturing activity in the world’s largest economy eased in March, slipping from last month’s four-year high figure.

The PMI for March slipped to 55.5, down from the previous month’s figure of 57.1. The figure fell short of economist expectations for a figure of 56.5, but was ahead of January’s weak figure of 53.7, suggesting that the impact of the winter’s harsh weather conditions is easing. Any figure above 50 indicates expansion whilst a figure below indicates a contraction.

“The survey adds to evidence that the sector has shrugged off the weather related weakness seen earlier in the year. The still solid showings for output and new orders are encouraging news,” said Markit’s Chief Economist Chris Williamson.

Against the Euro the ‘Greenback’ was trading higher due to the publication of a mixed set of PMI data from the Eurozone.

Manufacturing output in France rebounded strongly to its highest level in 33 months, easing worries over the health of the French economy. A similar report out of Germany however softened the single currency as PMI data there came in below economist forecasts.

With a lack of domestic data the Pound was relatively stable as investors await the release of tomorrow’s important UK inflation data and US Consumer confidence reports.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Euro,0.7257 ,

,Euro,0.7257 ,

US Dollar, , Pound Sterling,0.6064 ,

, Pound Sterling,0.6064 ,

US Dollar, ,Australian Dollar,1.0961 ,

,Australian Dollar,1.0961 ,

US Dollar, ,Canadian Dollar,1.1209 ,

,Canadian Dollar,1.1209 ,

Pound Sterling, ,US Dollar,1.6487 ,

,US Dollar,1.6487 ,

[/table]

Comments are closed.