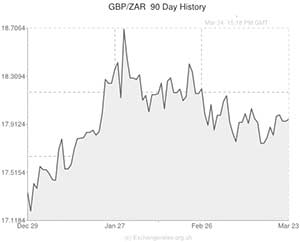

While the Rand began local trading holding steady against peers like the Pound, the GBP/ZAR and USD/ZAR pairings may fluctuate over the next few days.

The Pound was putting in a fairly patchy performance as a new week of trading began but managed to advance on the Rand following the release of less-than-impressive manufacturing data for China.

A report showing a fifth month of contraction in China’s manufacturing sector weighed heavily on commodity-driven assets and the Rand broadly declined.

The HSBC/Markit gauge of Chinese manufacturing dropped to an eight-month low of 48.1 in March, adding to growing concerns of a slowdown in the world’s second largest economy.

Some industry experts believe that this latest less-than-impressive result will encourage Beijing to introduce additional stimulus.

Reuters quoted economist Wei Yao as saying of the news; ‘Usually, for the month of March, the PMI will rebound, because after Chinese New Year, there should be some activity coming back, but this PMI is disappointing. The government probably will have to provide some supporting measures. I think the slowdown is not over yet and our expectation is that the deceleration will continue in quarter two.’

The Rand edged lower against its UK and US rivals in response to the Chinese news and was further knocked as measures of manufacturing and services for the Eurozone (a major SA trading partner) came in slightly shy of forecasts.

As trading continued the Rand was holding steady as a lack of economic news from the UK and South Africa restrained movement in the GBP/ZAR pairing.

With all of the week’s major South African news not scheduled for publication until Thursday, Rand movement will largely result from global economic developments.

During the North American session disappointing US manufacturing data helped the Rand recover ground against the ‘Greenback’.

Tomorrow UK inflation figures will be the main cause of Pound to Rand volatility, but investors will also be looking ahead to Thursday and the publication of South African PPI and the Reserve Bank’s interest rate decision.

In reference to the last SA Monetary Policy Committee announcement, Barclays asserted; ‘The Rand has proven surprisingly stable since the last MPC. We are maintaining our previous call of a 50 basis point rate hike but with some trepidation, and would not be greatly surprised if the South Africa Reserve Bank stays on hold.’

Other UK reports to look out for in the days ahead include retail sales and growth data.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.8398,

,South African Rand,17.8398,

Euro, ,South African Rand,14.9008,

,South African Rand,14.9008,

US Dollar, ,South African Rand,10.8465,

,South African Rand,10.8465,

Australian Dollar, ,South African Rand,9.8658,

,South African Rand,9.8658,

New Zealand Dollar, ,South African Rand,9.3257,

,South African Rand,9.3257,

Canadian Dollar, ,South African Rand,9.6718,

,South African Rand,9.6718,

[/table]

Comments are closed.